JULY 2019

Prescription Drugs and Pharmacy Benefit Management

Presciption drug prices continue to rise, but a well-structured pharmacy benefit management program may help control the costs associated with an employer’s drug program while also improving the plan’s performance and member experience.

At My Benefit Advisor, our staff knows employers are growing increasingly concerned about the percentage of premium dollars their clients are allocating to the cost of their employee’s prescription drug expenses. But by untilizing the services of a few key Pharmacy Benefit Managers (PBMs), our experts have developed effective strategies to help reduce the costs of prescription drug programs for many clients, including those with fully insured plans, self-insured funding arrangments, union plans and association plans.

We can provide you with information on how PBMs can help your company reduce it’s prescription drug costs and improve the overall quality of your employee’s benefit experience.

Perspective

Prescription drugs have evolved over the past several years to become the top health care cost driver for employers as Americans continue to spend more on prescriptions than any other country in the world. Principally due to specialty drugs (the high-cost medications use to treat complex diseases that are mostly injected or administered intravenously), business owners of all sizes are looking to develop new strategies in their attempt to provide employees coverage for prescription drugs at a reasonable cost.

Carving out the pharmacy benefit from a medical plan and contracting directly with a Pharmacy Benefit Manager (PBM) has emerged as one such strategy. PBMs are entities staffed with professionals who administer prescription drug programs for both insurance carriers and employers. As a result of their membership volume and relationships with drug companies, they possess competitive negotiation capabilities. With their sophisticated technology and data analytic programs, they can more effectively curb unnecessary prescription drug spending while also permitting more targeted care for those diagnosed with critical illnesses.

Prescription Drugs and Pharmacy Benefit Management: A Brief Overview

Employers typically look to provide the best possible healthcare benefits for their employees while always balancing that with the value they get in return for their premium dollars. When it comes to prescription drugs, their objective has become increasingly difficult to achieve as for a variety of factors the cost of drug coverage has increased sharply over the past several years.

Pharmacy Benefit Managers (PBMs) were developed many years ago as the private market struggled to solve this problem. A PBM is a company that administers the drug benefit program for an insurance provider or employer. They negotiate directly with drug makers in an effort to lower prescription drug prices, increase competition for more generic equivalents and obtain rebates for individuals and employers.

A PBM can manage prescription drug plans for a variety of insurance providers, including commercial health plans, Medicare Part D plans, federal and state employee health programs, self-insured plans or other employer groups. Their focus is creating a collective buying power comprised of enrollees from their various plans, enabling all the ability to obtain lower prices for the prescription drugs they need.

Their position takes on the role of “advocate” for the consumer and in addition to seeking ways to lower cost, they also strive to improve patient convenience, drive increased satisfaction and assure the safety of prescription drug administration.

Few PBMs are owned and operated independently, as most operate within integrated healthcare systems, as a part of retail pharmacies, or subsidiaries of managed care plans or insurance companies. Most of the larger PBMs are well known although names are changing constantly as a result of mergers and acquisitions. CVS/Aetna, Cigna/Express Scripts and ProCare RX are just a few of the many PBMs that compete in the industry. Addtionally, there are dozens of smaller, but still significant players. One of the key driving forces behind the mergers is, of course, that the larger the PBM, the greater negotiating power it has. Several new retail and tech companies are also joining in, with names like Amazon, Walmart, Goodle and Apple all looking to make an impact.

As employers continue to look for more effective ways to manage the rising cost of prescription drug prices, PBMs can be a useful tool to maximize the employer’s return on investment and improve user satisfaction.

In this paper, we’ll take a look at the factors driving prescription drug prices higher, why specialty drugs bear a good deal of the blame and how a PBM can benefit employers.

Factors Driving Up Prescription Drug Prices

Millions of people in America rely on prescription drugs to manage health conditions, moreso than almost any other country. And unfortunately, drug prices have been increasing at a rate higher than inflation for some time now, impacting both individuals and employers. Even more revealing is that the cost of prescription drugs accounts for more than 22 percent of the overall premium dollar spent on healthcare.

Efforts to slow the price increases for prescription drugs are up against the powerful and complex forces that make up the drug industry.

The reasons for high prescription drug prices are many and complex in nature, but there are a few primary cost drivers:

- Utilization

- Lack of Competition Among Drug Makers,

- Mix of Brand vs. Formulary Drugs used, and

- The High Cost of Specialty Drugs and Their Administration.

Let’s take a look at each of these factors in a bit more detail

Utilization

Utilization of drugs has increased over the years due to the number of new drugs that have been introduced, the changes in treatment regimens and more effective identification of diseases. Additionally, overutilization has driven up costs, as our fee-for-service system provides incentives for pharmacies, physicians and drug manufacturers based on services provided, the number and day supply of prescriptions filled and volume of pharmaceutical drugs sold.

Lack of Competition

Due largely to abuses in the patent system, drug makers have created monopolies by filing for redundant patents with the strategic intent to block any generic alternatives for their drugs. These patent monopolies allow the drug company to maintain high prices by preventing competition for their brand drugs.

Mix of Brand vs. Formulary Drugs Used

The mix of higher priced brand drugs versus less expensive formularies used by individuals impacts the overall cost of prescription drug costs.

High Cost of Specialty Drugs

Specialty drugs, or “biologics” as they are called when produced from living cells) are used to treat a variety of serious conditions. Because they require special storage, careful handling and unique methods of administration, they come with big pricetags and those pricetags continue to escalate.

Key Prescription Drug Cost Control Strategies

Through Plan Design:

- Consumer Cost Sharing

- Deductibles

- Copayments

- Coinsurance

- Formulary

- Generic Substitution

- Therapeutic Interchange

- Distribution Channels

Through Management:

- Utilization Management

- Quantity Limits

- Supply Limits

- Prior Authorization

- Step Therapy

- Drug Utilization Review

- Pharmacy Network Discounts

- Manufacturer Discounts/Rebates

- Clinical/Educational Programs

What Are Specialty Drugs and Why Are They So Expensive?

Specialty drugs are medications that are used to treat complex, chronic medical conditions and are by their nature, expensive and complex to administer. Not typically stocked by local retail pharmacies, these drugs must be delivered by “specialty pharmacies” and due to their delicate nature, require special administration, monitoring and handling to assure patient safety.

They are often given by injection or infusion and are potential life savers for patients undergoing treatment of a number of cancers, rheumatoid arthritis, multiple sclerosis and other rare diseases.

As recently as the mid-1990s, there was only a few specialty drugs on the market. Today, there are hundreds of specialty drugs available.

The rapid increase in specialty drug spending in this relatively short time has placed an enormous burden on businesses that have seen these cost increases translate to much higher prescription drug premiums, creating an urgent need for substantial changes to our country’s pharmacy and drug therapy management system.

There are a few strategies employers have at their disposal to contain the rise in premiums due to specialty drug spending:

- Traditional Utilization Management programs can require prior authorization and step therapy.

- Use of Tiered Formularies requiring higher cost sharing for more expensive medications.

- Utilization of Lowest Cost Sites typically, administration of medications at a person’s home or in a physician’s office is less expensive than the hospital outpatient department.

- Network Management requiring usage of a tightly managed, controlled network can provide greater discounts and mitigate waste.

As specialty drugs continue to account for an increasingly significant portion of overall health care spending, employers and pharmacy benefit managers will be challenged to develop new strategies to enable patients access to these beneficial drugs while controlling their rapid rise in cost.

What Is Meant by Pharmacy Carve-Out?

For many employers, the prescription drug program they provide as part of their employee benefit program is packaged in with the medical coverage, otherwise called a “carve-in” program. An option for employers is to “carve-out” the prescription drug benefits from the medical program, creating a free-standing drug program. From a rating perspective, a carve-out prescription program can be either fully-insured or self-insured.

When the prescription program is carved-in, there are fees charged by the health plan for its role as “intermediary” that the employer must pay. Likewise, in a carve-in situation, the employer has little control over the details and management of the program. By carving-out the prescription program, the employer gains control and can work with the PBM to tailor the program to more closely fit the demographics, utilization patterns and needs of the employer.

Carve-out programs provide the employer with the ability to negotiate better pricing and contract terms, provide a greater transparency of all factors affecting employer cost, improve data capture and allow for employer directed audits. Additionally, by contracting directly with a PBM, the employer has greater control over program design and can create customized clinical care programs, while both HR and the employees have acces to a dedicated customer service team that are dedicated and specially trained in prescription drug services.

So how should an employer determine if a prescription carve-out is right for them? Access to utilization and supporting data is a big help, but not always available. For this reason, and because if chosen, the terms and jargon of most PBM contracts may seem overwhelming for the untrained HR person, the counsel of an experienced benefit consultant can assist with the decision and any transition process.

Pharmacy Benefit Management Options

Carve-In

The same vendor providing medical benefits also manages the pharmacy benefit. In this scenario, the contract is between the medical vendor and the pharmacy benefit manager and the employer has little control over the terms and conditions.

This arrangement works for either fully-insured or self-insured groups, although it is more often used for smaller groups.

VS.

Carve-Out

In this scenario, the pharmacy benefits are carved-out from the medical benefit plan and the employer contracts the pharmacy benefit management services directly. This provides the employer with greater control over contract provisions and also eliminates some fees.

This arrangement typically works best with larger groups.

Key Benefits of Prescription Carve-Out

Although in many daily situations the “bundle and save” strategy may work, when it comes to medical and pharmacy benefits, that may not always be the best approach. By carving out the prescription drug benefits, an employer may realize the following key benefits:

Lower Drug Costs

By carving out the pharmacy benefits, an employer can more aggressively negotiate drug and administrative fee pricing and spreadsheet multiple PBMs to determine the best value for their group. This is especially true when the increasingly popular but high-cost specialty drug market is factored in. Also, the employer can negotiate for better discounts, rebates and incentives.

Better Control Over Contracting

By carving out the prescription benefits, employers get to contract directly with the PBM, eliminating the fees charged by a medical carrier for a carve-in program. Additionally, the employer is able to customize the program to fit their own specific needs, and negotiate in programs and services that can impact overall cost by managing risk and focusing on improvement of clinical outcomes.

Greater Transparency

With pharmacy carve-out, the employer has access to a greater variety of cost-related data, including the actual cost of the drugs and their markups, any discounts, rebates, contracted volume discounts, etc. Greater transparency means the employer will no longer be in the dark regarding specific drug mark ups or other factors that could increase the cost of their prescription drug program.

Improved Data Management and Audit Capabilites

Direct contracting with PBMs allows employers to access claims data reports which will provide greater insight into utilization trends, enhancing their ability to make more informed benefit decisions. And by working directly with a PBM, the employer has audit rights, which is virtually impossible to them to have with a carve-in program.

Directed Clinical Oversight

By analyzing the pharmacy claims data, the employer can work with the PBM and take advantage of their clinical experience and familizarization with various pharmacy strategies relating to specific aspects of the program, such as formulary management and drug therapies to improve adherence, mitigate fraud and waste, optimize care and lower overall cost.

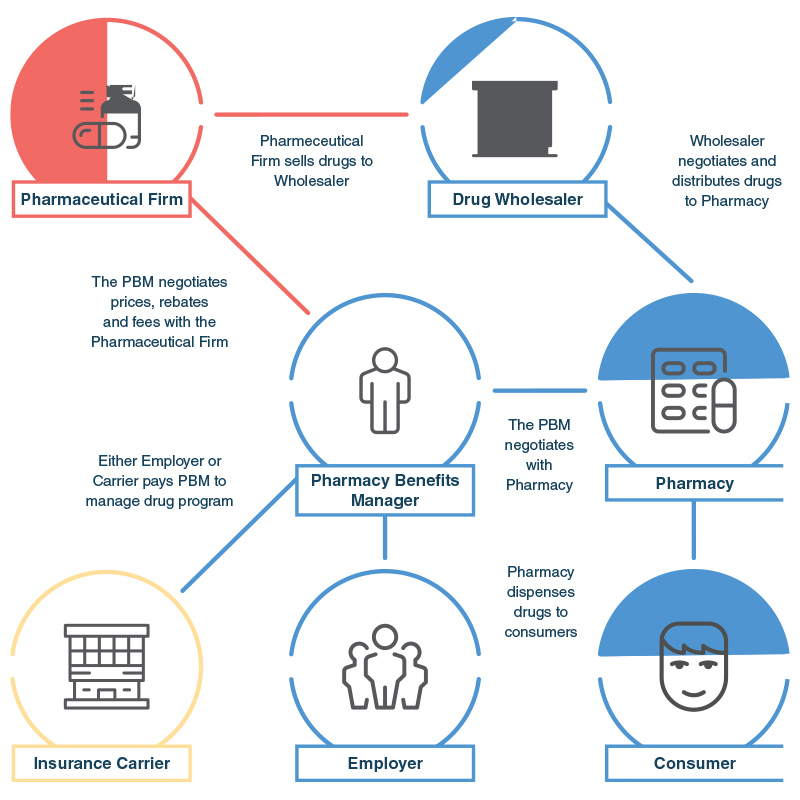

Distribution of Drugs To Consumers and The Role of a Pharmacy Benefit Manager

The PBM plays a critical role in the distribution of prescription drugs to the consumer, either via an insurance carrier or an employer.

Case Study:

Specialty Drug Management to Control Prescription Drug Prices

The Issue

When reviewing claim utilization data with one of our large clients, due to a high medical plan premium increase, we discovered that the cost of specialty drugs accounted for nearly half of their drug claim utilization, even though they were attributable to only 12 employees out of the company’s 478 employees.

Our Solution

Specialty drugs are often biologics (drugs derived from living cells) that are high-cost, highly complex and often times, high touch (injected or infused). They are often used to deal with difficult conditions like cancer, multiple sclerosis, rheumatoid arthritis, psoriasis, etc. and typically require special handling, administration and monitoring. Although such treatment programs can be highly successful, cost controls are necessary to assure proper use of the drugs. We developed an aggressive utilization management program, requiring any specialty drug claimants to:

- Obtain prior authorization when a specialty drug is ordered by a provider,

- Follow a step therapy program, and

- Adhere to certain quantity limits.

Impact/Result

After one year, the specialty drug utilization management program produced a significant reduction in specialty drug claim costs, saving the company over $128,000.

Additional Info

Categories

Our team thrives on helping businesses achieve success

Contact us and let us prove our value to you

Our website uses cookies. Click here to view our privacy policy.