September, 2019

Human Resource Tools

Through the use of innovative and cutting-edge technology, human resource and benefit administration processes can be streamlined, allowing for enhanced efficiencies and better positioning your company for future growth and success.

Perspective

As employers continue to face rising healthcare costs and increased regulatory requirements, the strain on their human resource departments have demanded that new strategies be developed.

The HR and Benefit Administration Team at My Benefit Advisor has risen to this challenge by focusing on the development of a customized solution for each customer by finding the right tools, technology and services to help manage all aspects of the HR and Benefit Administration experience.

If your firm’s HR solution consists of a patchwork of forms, emails and spreadsheets stored in metal filing cabinets or local hard drives, you may need to seriously consider an upgrade!

Even if you think you think you are a bit more sophisticated than that, it should be noted that through advancements in technology a plethora of robust HR solutions has come to the marketplace recently, accommodating a wide spectrum of needs for companies of all sizes. Most of these options are priced competitively and can pay off quickly…saving you valuable time and helping reduce the financial liability that can come from errors or omissions in policies, practices and procedures.

In this paper, we’ll discuss some of the more popular HR solutions available to small to mid-size businesses today, with a brief overview of the main features and benefits of each. Along with our personal guidance, we hope to assist you in developing a strategy to maximize the use of your firm’s budget to more efficiently manage your HR responsibilities and successfully grow your business.

Human Resource Tools: A Brief Overview

Most small to mid-size businesses don’t have an HR specialist on staff…they simply can’t afford to. Often, the human resource tasks fall to the business owner as an additional responsibility, and of course, this takes the owner away from their most important role…running the business! Assigning this task to another employee is also an option, but again, it is probably just one of several functions the employee is responsible for.

A full-time HR person is simply not viable for most small to mid-sized companies.

Regardless of who handles the role of HR specialist in the small to mid-sized firm, HR tools have become increasingly critical to the successful management of the increasingly complex day-to-day responsibilities required to maintain compliance with business regulations. And with substantial penalties and fines for non-compliance, businesses can’t afford to take their chances and “hope they don’t get caught”.

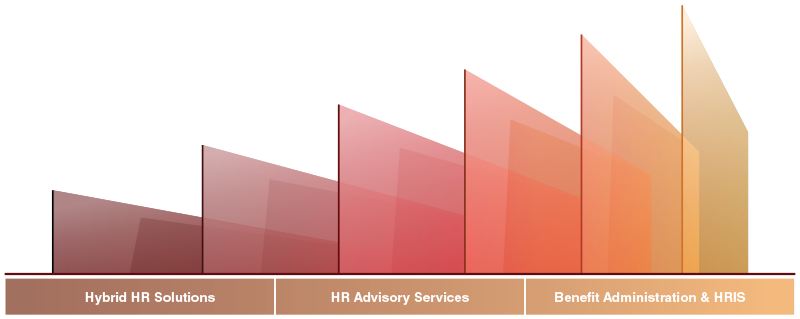

The good news is that there are a wide variety of solutions to choose from, all designed to simplify, organize, streamline and automate your organization’s HR processes and database. From basic, hybrid HR solutions to human resource advisory services and full-blown Benefit Administration and HRIS, there’s a cost-effective strategy that can benefit your firm.

Regardless of the application you choose, these systems contain resources to help your company manage the following crucial HR tasks:

- Organization of the recruitment process, from candidate screening through onboarding and training

- Managing your company’s pool of talent, building relationships, tracking performance reviews and appraisals

- Maintaining compliance with legislative requirements

- Extracting corporate data to analyze and identify patterns and trends, including report generation

By utilizing technology and the packaged resources most of these products provide, you can more effectively focus your time and resources on growing a dynamic and successful business.

Spectrum of HR Solutions:

Solutions available today are tailored to suit a wide variety of needs, from basic online platforms to comprehensive, full-blown HRIS and Benefit Administration Systems.

Basic Services: Hybrid HR Solutions

Hybrid HR solutions combine the best in live human resource expertise with innovative online technology to deliver trusted HR knowledge solutions that enable your organization to thrive. Using these tools, HR professionals can be more effective in their roles, building a positive and productive workplace. Services from these providers typically include:

Advanced HR knowledge and training — usually an integrated suite of advanced HR knowledge and training solutions that provide everything employers need to create and maintain a compliant and productive workplace.

Advanced HR knowledge and training — HR professionals are typically provided with access to certified advisors ready to answer questions, provide guidance and follow up with research to resolve tricky HR issues.

Employee Training Programs — Courses offered usually cover topics like mitigating legal risk, maintaining compliance and enhancing employee engagement. Dashboards allow HR professionals the ability to administer the programs easily and track usage.

Compliance Tools — Forms, checklists and tools that allow HR professionals with the ability stay up-to-date with the latest information on changing regulations and more easily maintain compliance.

Enhanced Service Level: Human Resource Advisory Services

Most business owners often wear multiple hats and find that many critical HR tasks are in danger of falling through the cracks. This could lead to personnel problems, costly consultation fees, and potentially expensive and time-consuming fines, penalties and/or lawsuits. You probably already outsource accounting and payroll services, but have you thought of outsourcing your company’s HR services?

Generally, HR Advisory firms provide a range of human resource guidance and support to help you better manage your employee HR needs and ensure your compliance within the evolving landscape of regulations to help reduce your legal and financial risk. In providing your company with HR expertise, they provide you with valuable guidance, whether it involves assistance with administrative services, insights into best practice or analytical tools to help examine areas of potential non-compliance.

These firms can also take on the management of many difficult and sensitive employee issues, so you are free to run your business. Specifically, these firms focus on:

- HR Compliance and Risk Assessment

- Employee Handbooks

- Job Descriptions

- Hiring and Termination Processes

- Performance Management

- Leadership Training, and more

Comprehensive Service Level: Benefit Administration & HRIS

Given the complexities in today’s employer benefits environment, it has become increasingly critical that employers place a priority on ensuring compliance, securely maintaining and transmitting data and maximizing efficiencies through streamlined administrative processes. Today’s benefit administration systems can provide tremendous value in these areas and have emerged front and center in employer’s quest for forward looking strategies.

Many human resource departments today are forced to stretch their limited staff and budget, making operational efficiency an absolute necessity. Benefit Administration, the process of assembling and managing corporate benefit components, has come a long way since just a few years ago and provides a viable solution in this regard for many businesses.

Today, a good insurance broker or benefit consultant can find a dynamic technology solution tailored to a client’s specific needs and demographics, allowing for a comprehensive yet intuitive experience for all users. Today’s systems allow for automation and simplification of all HR and benefit related processes, improving administrative efficiencies and enhancing user engagement in all core areas.

Some of the highlights of today’s benefit administration systems include:

Automation of HR tasks — uincluding recruiting, applicant tracking, onboarding and termination processes, PTO tracking and scheduling, time clocks, time management, performance reviews, goal setting, ongoing employee learning and development, career development, etc.

HR Information and Payroll Integration — Reports and predictive analytic tools for monitoring key business metrics and identification of trends, either embedded payroll functionality or synchronization of data with most major payroll companies.

Compliance — helping companies navigate the fluid and challenging legislative environment, including tax management and ACA reporting requirements.

Benefit Administration — A simplification of enrollment processes, including replacement of paper forms with electronic files, online benefit enrollment, benefit cost transparency, seamless and direct integration with carrier and vendor eligibility systems, consolidated billing, single click COBRA administration and more.

Many benefit administration systems also include mobile apps that have self-serve functionality, enabling employees to make changes in benefits, engage in corporate communications and even interface with health tracking devices, without the need of a desktop computer.

Specific HR Concerns That Can Be Addressed Through HR Technology

In addition to packaged HR tools, there are several key areas of concern for business owners that present liability issues if not properly administered. Although many of these tasks can be performed in-house, applications and vendors are available to provide assistance to employers for these specific aspects of HR and Benefit Administration.

COBRA Administration

The Consolidated Omnibus Reconciliation Act (COBRA) provides an option for employees to continue their health coverage if they lose their job due to a qualifying event. To qualify for COBRA, the employee must have coverage under the group health plan the day before a qualifying event occurs. A qualifying event is any of the following:

- A reduction in hours

- Retirement

- Voluntary resignation

- A strike or walkout

- A layoff

- Other employment termination for a reason other than gross misconduct

In these situations, the employee and their dependents are entitled to 18 months of continued COBRA coverage. Additionally, the spouse and/or children of a qualified employee are entitled to 36 months of coverage as a result of:

- Death of the covered employee

- Divorce or legal separation

- The employee becoming eligible for Medicare benefits

- A dependent child ceasing to be eligible under the employee’s medical plan

Once a qualifying event occurs, the employer will send (within 14 days) the employee a notice informing them of their eligibility. Normally, the employee has 60 days to accept coverage. COBRA beneficiaries may only be charged 102% of the applicable premium (the extra 2% is an optional administrative fee the employer may include). The coverage under COBRA is the same coverage that existed under the group plan.

Although the federal COBRA plan applies to any company with 20 or more full and/or part time employees (during at least 50% of the prior year), many states have similar laws that apply to smaller companies.

As a business owner, you may find COBRA to be complex process to administer and find it difficult to keep abreast of changing requirements from year to year. Failure to keep up on these changes can be costly as non-compliance can result in significant penalties, legal fees and loss of staff productivity. A reputable COBRA vendor can simplify the process for you, maximizing your efficiency and minimizing any chance for errors or the costly fines and penalties associated with them.

5500 Form Completion

ERISA plans with 100 or more participants on the first day of the plan year are required to file a Form 5500 with the Department of Labor. If required to do so, these forms must be filed no later than 7 months (or up to 9 ½ months with extensions) after the end of the plan year. A two and one-half month extension may be obtained by filing Form 5558 with the IRS.

If benefits are not contained within a single plan, a separate Form 5500 must be filed for each benefit plan with 100 or more participants on the first day of the plan year. A “wrap” document can be used to combine all employee benefits into a single plan to reduce the number of 5500 Forms required.

Penalties for not filing a Form 5500 can be up to $1,100 per day, beginning on the date the form was due. Additionally, these failure to file penalties are cumulative, so if there is more than one filing outstanding, penalties can accrue separately for each Form 5500 due.

Who Is Considered a Participant for Form 5500 Determination?

When determining whether your company is required to file Form 5500, the following individuals should be included:

- Active Participants (current employees covered by the plan)

- Participants who are either retired or separated from service, receiving benefits (includes COBRA participants)

- Participants either retired or separated from service, entitled to future benefits

- Deceased participants whose beneficiaries are either receiving or entitled to receive benefits

Wrap Plan Documents

Under ERISA, any employer that provides certain benefits to its employees, such as medical insurance or other types of coverage, is considered to have established an “employee welfare benefit plan”. Although there are a few exceptions, providing these welfare benefits to their employees requires an employer to comply with ERISA.

One of these requirements is that the employer offering an employee welfare benefit plan must have a written document containing all the terms governing the plan. The written contract issued by an insurance company typically does not contain all the rules required by ERISA, such as eligibility requirements, plan participation rules and the length of coverage.

A “Wrap” document provides all the information required by ERISA by “wrapping around” (incorporating) the insurance contract and can even include multiple plans of coverage.

Determination of Full-Time Equivalent Employees (FTE)

The Affordable Care Act distinguishes large employers from small employers and assigns a different set of responsibilities to each group.

If an employer has at least 50 full-time employees, including full-time equivalent employees, on average during the prior year, the employer is considered an Applicable Large Employer (ALE) for the current calendar year and is, as a result, subject to the Employer Shared Responsibility Provisions and the Employer Information Reporting Provisions.

A full-time employee for any calendar month is an employee who has on average at least 30 hours of service per week during the calendar month, or at least 130 hours of service during the calendar month.

Full-Time Equivalent Employees

A full-time equivalent employee is a combination of employees, each of whom individually is not a full-time employee, but who, in combination, are equivalent to a full-time employee. An employer determines its number of full-time equivalent employees for a month in the following two steps:

- Combine the number of house of service of all non-full-time employees for the month but do not include more than 120 hours of service per employee, and

- Divide the total by 120.

An employer’s number of full-time equivalent employees (or part-time employees) is only relevant in determining whether an employer is an ALE. An ALE need not offer minimum essential coverage to its part-time employees to avoid an employer shared responsibility payment.

Case Study: Avoiding Costly Compliance Penalties

The Issue

After completing a compliance review for a newly acquired client that had increased in size from approximately 63 employees to just over 170 employees in the past 3 years, our team discovered that the required 5500 forms had not been completed for two of those past three years. According to federal law under ERISA, health and welfare plan sponsors with 100 or more participants at the beginning of a plan year are generally required to file an annual report with the Department of Labor/IRS. This “Form 5500” contains information about the plan and includes disclosure of all commissions and fees received by those who provide services to insured plans. Failure to file these forms by the required deadlines could result in an IRS penalty of $25 per day, up to a maximum of $15,000. The DOL penalty for late filing can run up to $1100 per day with no maximum.

The Solution

Although they passed 100 employees during the first year of their rapid growth, they began the year with less than 100 employees and were exempt from filing for that year. However, we advised the client that they were, in fact, delinquent for the second two years and were facing the potential of substantial penalties. After collecting the necessary plan data from each year, we assisted the client in completing and filing an electronic 5500 form for both years and then prepared a special filing under the “Delinquent Filer Voluntary Correction Program” (DFVCP) offered by the IRS and Department of Labor. Under the DFVCP program, the client’s liability for financial penalties dropped from hundreds of thousands of dollars to the limit of $2000 for each annual report, not to exceed $4000 per plan. If the Department of Labor were to have conducted an audit before the DFVCP was filed and discovered the delinquency, the plan sponsor would have been prohibited from using the DFVCP and would have been responsible for the significantly higher penalties.

Impact/Result

Plan compliance today is complex and spans a multitude of areas and required processes, from 5500 filings to “Pay or Play” to COBRA and FMLA, just to name a few. Requirements vary by number of employees, and process deadlines are scattered throughout the year. With proper guidance and suggested compliance audits we can help clients resolve potential problems before they become expensive mistakes.

Additional Info

Categories

Our team thrives on helping businesses achieve success

Contact us and let us prove our value to you

Our website uses cookies. Click here to view our privacy policy.